Ever pretend you know what your friends are talking about because you want to sound smart and relevant—and then trap yourself in a lie?

“Wow, looks like those hackers were mining for cryptocurrency. You know what cryptocurrency is, right?”

“Oh yeah, totally. Cryptocurrency. Bad stuff. You know. Currency? In the crypt? Bad.”

“Yeah….”

Okay, so the next time someone asks, “What is cryptocurrency, anyway?” instead of awkwardly shrugging, be prepared to dazzle them with your insider knowledge.

What is cryptocurrency, in a nutshell?

In its simplest form, cryptocurrency is digital money. It’s currency that exists in the network only—it has no physical form. Cryptocurrency is not unlike regular currency in that it’s a commodity that allows you to pay for things online. But the way it was created and managed is revolutionary in the field of money. Unlike dollars or euros, cryptocurrency is not backed by the government or banks. There’s no central authority.

If that both excites and scares you, you’re not alone. But this technology train has left the station. Will it be a wreck? Or will it be the kind of disruptive tech that democratizes the exchange of currency for future generations?

Let’s take a closer look at what cryptocurrency is, how it works, and what are the possible pitfalls.

What makes cryptocurrency different from regular money?

If you take away all the techno-babble around cryptocurrency, you can reduce it down to a simple concept. Cryptocurrency is entries in a database that no one can change without fulfilling specific conditions. This may seem obtuse, but it’s actually how you can define all currency. Think of your own bank account and the way transactions are managed—you can only authorize transfers, withdrawals, and deposits under specific conditions. When you do so, the database entries change.

The only major difference, then, between cryptocurrency and “regular” money is how those entries in the database are changed. At a bank, it’s a central figure who does the changing: the bank itself. With cryptocurrency, the entries are managed by a network of computers belonging to no one entity. More on this later.

Outside of centralized vs. decentralized management, the differences between cryptocurrency and regular currency are minor. Unlike the dollar or the yen, cryptocurrency has one global rate—and worth a lot. As of November 2017, one Bitcoin is equal to $6,942.77. Its value has increased exponentially this year, exploding from around $800 in January 2017.

How does cryptocurrency work?

Cryptocurrency aims to be decentralized, secure, and anonymous. Here’s how its technologies work together to try and make that happen.

Remember how we talked about cryptocurrency as entries in a database? That database is called the blockchain. Essentially, it’s a digital ledger that uses encryption to control the creation of money and verify the transfer of funds. This allows for users to make secure payments and store money anonymously, without needing to go through a bank.

Information on the blockchain exists as a shared—and continuously reconciled—database. The blockchain database isn’t stored in a single location, and its records are public and easily verified. No centralized version of this information exists for a cybercriminal to corrupt. Hosted by millions of computers simultaneously, its data is accessible to anyone on the Internet.

So how, exactly, is cryptocurrency created and maintained on the blockchain? Units are generated through a process called mining, which involves harnessing computer power (CPU) to solve complicated math problems. All cryptocurrencies are maintained by a community of miners who are members of the general public that have set up their machines to participate in validating and processing transactions.

And if you’re wondering why a miner would choose to participate, the answer is simple: Manage the transactions, and earn some digital currency yourself. Those that don’t want to mine can purchase cryptocurrency through a broker and store it in a cryptocurrency wallet.

When was cryptocurrency developed?

In the wake of Occupy Wall Street and the economic crash of 2008, Satoshi Nakamoto created Bitcoin, a “peer-to-peer electronic cash system.” Bitcoin was a slap in the face to the “too big to fail” banks because it operated outside of a central authority, with no server and no one entity running the show. Bitcoin pioneers had high hopes of eliminating the middle man in order to cancel interest fees, make transactions transparent, and fight corruption.

While Bitcoin was the first and remains the most popular cryptocurrency, others saw its potential and soon jumped on the bandwagon. Litecoin was developed in 2011, followed by Ripple in 2012. In 2015, Ethereum joined the fray and has become the second most-popular cryptocurrency. According to CoinMarketCap, there are now more than 1,000 cryptocurrencies on the Internet.

Cryptocurrency’s popularity on the Internet soon bled into other real-world applications. Japan has adopted Bitcoin as an official currency for commerce. Banks in India are using Ripple as an alternative system for transactions. JP Morgan is developing its own blockchain technology in partnership with Quorum, an enterprise version of Ethereum.

However, as with any new and relatively untested technology, the cybercriminals wanted in. And it wasn’t long before Bitcoin and other cryptocurrencies fell victim to their own democratic ideals.

How has cryptocurrency been abused?

As secure as a Bitcoin address is, the application of its technology is often fumbled; usually by unpracticed programmers looking to get in on the action and creating faulty code. Fundamentally, the system is superior to centralized database systems, but poor coding practices among its thousands of practitioners have created a multitude of vulnerabilities. Like vultures to carrion, cybercriminals flocked to exploit. According to Hacked, an estimated 10 to 20 percent of all Bitcoin in existence is held by criminals.

While cryptocurrency was initially hailed as the next big thing in money, a savior for folks who just lost everything in steep recession (but watched as the banks that screwed them over walked away unscathed), a hack in 2011 showed how insecure and easily stolen cryptocurrency could be. Soon, the criminal-minded rushed in, looking to take advantage of the cheap, fast, permission-less, and anonymous nature of cryptocurrency exchange. Over the last nine years, millions of Bitcoin, worth billions of dollars, have been stolen—some events so major that they drove people to suicide.

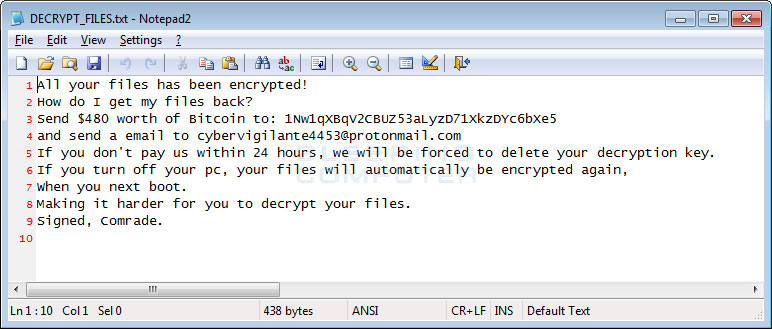

On a smaller but much more frequent scale, cryptocurrency is used on the black market to buy and sell credit card numbers and bot installs, fund hacktivism or other “extra-legal” activity, and launder money. It’s also the payment method of choice for ransomware authors, whose profits are made possible by collecting money that can’t be traced. Certainly makes getting caught that much more difficult.

And if that weren’t enough to call cryptocurrency unstable, the process of mining itself is vulnerable and has already attracted some high-profile hacks. Services such as CoinHive allow those that deploy it to mine the CPU of their site visitors—without the visitors’ knowledge or permission. This process, known as cryptojacking, is robbery-lite: Users may see an impact to their computer’s performance or a slight increase in their electric bill, but are otherwise unaffected. Or that is, they were, until cybercriminals figured out how to hack CoinHive.

Future applications

So where does that leave us with cryptocurrency? Surely its popularity is skyrocketing and its value is spiking so hard it could win a gold medal for beach volleyball at the Olympics. But is it a viable, safe alternative to our current currencies? Cryptocurrency could democratize the future of money—or it could end up in technology hell with AskJeeves and portable CD players.

We can see the technological applications for the future that demonstrate the clear advantages of cryptocurrency over our current system. But right now, cryptocurrency is good in theory, bad in practice. Volatile and highly hackable, we’ll have to move to create security measures that can keep up with the development of the tech, otherwise cybercriminals will flood the market so heavily that it never moves beyond the dark web.

If you want to learn even more about cryptocurrency, stay tuned for a deeper dive on blockchain technology and a full report on cryptojacking.